Sign up for Medicare in Mack, OH

Local licensed agents in Hamilton County are available to assist you if you need help comparing plans or registering for Medicare insurance.

Original Medicare

Original Medicare (Part A) covers most medically necessary services.

Medicare Supplement

Medigap plans provide additional insurance for out of pocket costs.

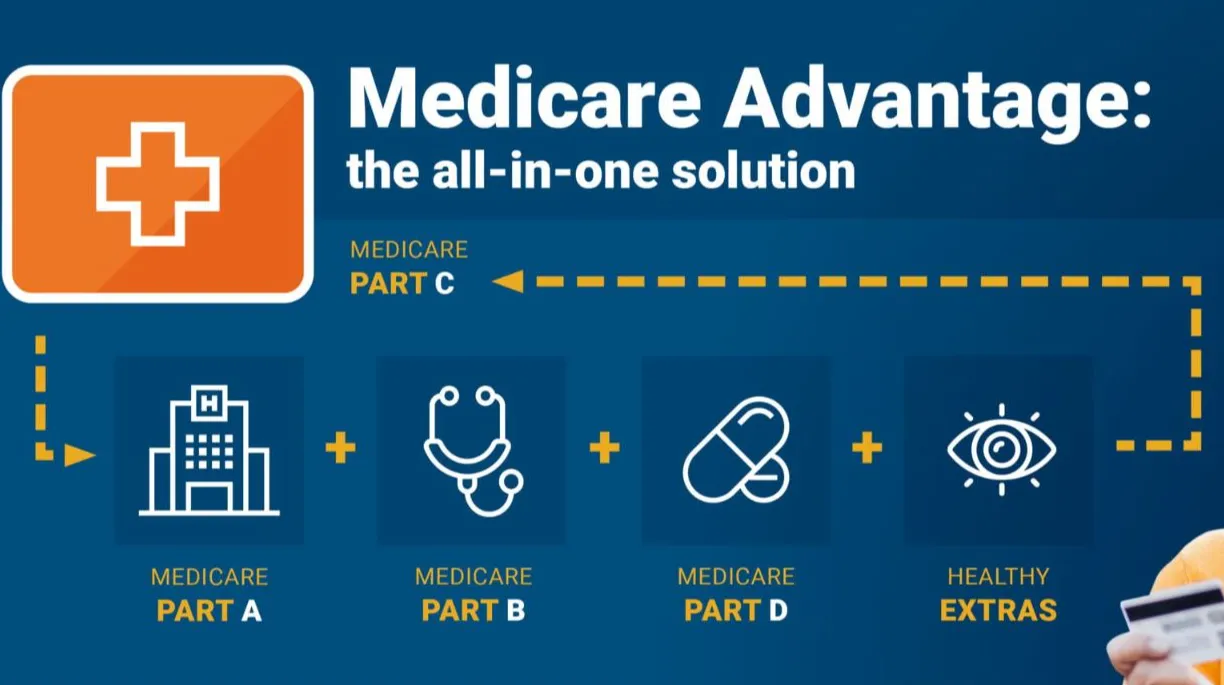

Medicare Advantage

A bundled alternative to Original Medicare for your health and drug coverage.

Not sure what Medicare plan is right for you?

Mack, OH Medicare Supplement Insurance Plan Comparison

First, decide between Traditional Medicare (which covers Parts A and B) and a private insurance's Medicare Advantage (known as Part C). If you go with Traditional Medicare, you'll probably also need a Medigap insurance to cover extra costs and a Part D plan for prescription drugs.

Medicare Advantage Plans: Age 65, Zipcode 45052, Non-smoker*

| Plan Type | Number of Plans Available | Average Monthly Premium | Lowest Monthly Premium | Highest Monthly Premium | Carriers |

|---|---|---|---|---|---|

| $0 OOP Medicare Advantage Plans | 79 | $0.00 | $0.00 | $0.00 | Aetna Medicare, Humana, CareSource MyCare Ohio (HMO D-SNP) |

| Paid Medicare Advantage Plans | 27 | $42.62 | $3.00 | $117.60 | Aetna Medicare, Humana, Medical Mutual of Ohio |

*Plan data last updated on 1/15/2026

Most Popular Medigap Plans: Female, Age 65, Zipcode 45052, Non-smoker*

| Plan Type | Number of Plans Available | Average Monthly Premium | Lowest Monthly Premium | Highest Monthly Premium | Carriers |

|---|---|---|---|---|---|

| Plan F | 36 | $217.32 | $149.24 | $434.38 | Anthem Blue Cross and Blue Shield of Ohio, Paramount, Omaha Supplemental, and 33 others |

| Plan G | 37 | $166.57 | $123.24 | $323.71 | Anthem Blue Cross and Blue Shield of Ohio, Paramount, Omaha Supplemental, and 34 others |

| Plan N | 36 | $129.31 | $91.32 | $256.76 | Anthem Blue Cross and Blue Shield of Ohio, Paramount, Omaha Supplemental, and 33 others |

*Plan data last updated on 1/15/2026

Most Popular Medigap Plans: Male, Age 65, Zipcode 45052, Non-smoker*

| Plan Type | Number of Plans Available | Average Monthly Premium | Lowest Monthly Premium | Highest Monthly Premium | Carriers |

|---|---|---|---|---|---|

| Plan F | 36 | $241.61 | $170.17 | $499.53 | Anthem Blue Cross and Blue Shield of Ohio, Paramount, Omaha Supplemental, and 33 others |

| Plan G | 37 | $185.57 | $136.22 | $362.49 | Anthem Blue Cross and Blue Shield of Ohio, Paramount, Omaha Supplemental, and 34 others |

| Plan N | 36 | $144.05 | $103.49 | $287.57 | Anthem Blue Cross and Blue Shield of Ohio, Paramount, Omaha Supplemental, and 33 others |

*Plan data last updated on 1/15/2026

Disclaimer: The information provided in these tables is for general informational purposes only. We make no guarantees about the accuracy, completeness, or reliability of the data. Please consult with a professional advisor or insurance provider for precise and up-to-date information.

Need help? Speak to a licensed Medicare insurance agent in Mack today

Evan Hountz

Licensed Medicare Agent

Contact Evan through Medicare Agents Hub »

Mack, OH Medicare Resource Center

Mack Medicare Information

Nestled in the heart of Hamilton County, choosing to sign up for Medicare in Mack, OH can be made simpler with MedicareSignups.com. With its advanced plan comparison tool, you have the power to explore numerous options handpicked for you. Despite Medicare being a national program, your options could differ based on your locale, even down to your specific zip code in Mack. Did you know that Mack is named after John Mack, an early settler and the first Justice of the Peace in Delhi Township? Like Mack's commitment to the community, MedicareSignups.com is committed to helping you choose the best plan when you decide to enroll in Medicare in Mack, OH.

Mack, OH Local Medicare Offices

Ohio Official State Health Insurance Assistant Program

Ohio's official state SHIP program is the Ohio Senior Health Insurance Information Program (OSHIIP). The mission of the Ohio Department of Insurance is to provide consumer protection through education and fair but vigilant regulation while promoting a stable and competitive environment for insurers.